The income a family of 4 needs to live comfortably in every state

Table Of Content

Our editorial team does not receive direct compensation from our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Besides entertainment, it has a diverse economy with strong sectors in technology, fashion, aerospace, and international trade. The Port of Los Angeles is one of the busiest ports in the world, playing a crucial role in global trade.

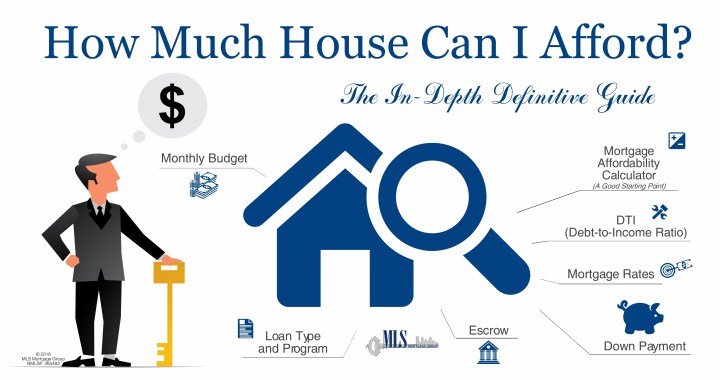

How Much House Can I Afford Calculator

If credit card debt is holding you back from getting to 36%, you might want to consider a balance transfer. You can transfer your credit card balance(s) to a credit card with a temporary 0% APR and pay down your debt before the offer expires. The answer to that question depends on your financial status and your goals. Just because a lender is willing to give you money for a home doesn’t necessarily mean that you have to jump into homeownership. It’s a big responsibility that ties up a large amount of money for years. But beyond that you’ve got to think about your lifestyle, such as how much money you have leftover for travel, retirement, other financial goals, etc.

Common terms

You might find that you don’t want to buy the most expensive home that fits in your budget. While maintaining a debt-to-income ratio under 36% protects you from minor changes in your finances, a cash reserve protects against major ones. Banks don’t like to lend to borrowers who have a low margin of error. That’s why your pre-existing debt will affect how much home you qualify for when it comes to securing a mortgage. If you can’t afford to buy a home with a conventional loan, you might benefit from one of these government loan programs designed to make home ownership more accessible. If you’re planning to buy a house, you’ll need to get a sense of how much home you can afford.

House affordability based on fixed, monthly budgets

VA loans generally do not consider front-end ratios of applicants but require funding fees. This can mean private mortgage insurance (PMI), which is an added monthly charge to secure your loan. If you don’t have enough money for a down payment, many lenders will require that you have mortgage insurance.

Custom Debt-to-Income Ratios

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Want a quick way to determine how much house you can afford on a $40,000 household income? Use our mortgage income calculator to examine different scenarios. Loans backed by the FHA can also have more relaxed qualifying standards — something to consider if you have a lower credit score.

Likely rate: 7.422% Edit rate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. Ultimately, how much home you can afford depends on your financial situation and preferences. It requires a more comprehensive decision than just how much money you want to spend on mortgage payments each month. The exact amount you should spend on a new home depends on your financial situation.

Homeowners Association (HOA) dues

Housing Market Predictions For 2024: When Will Home Prices Be Affordable Again? - Forbes

Housing Market Predictions For 2024: When Will Home Prices Be Affordable Again?.

Posted: Thu, 25 Apr 2024 16:49:00 GMT [source]

Having less debt can improve your credit score and increase your monthly cash flow. They will also decrease how much interest you pay on those debts. Many lenders use this ratio to determine if you can afford a conventional home loan without putting a strain on your finances or causing you to go into default. The 28/36 rule also protects borrowers as much as it protects lenders, as you’re less likely to lose your home to foreclosure by overspending on a home. This loan is a great option for anyone who is a veteran or currently serving in the United States military.

Buying Options

Though the city is famous for its glitz and glam, you don’t need to call yourself a millionaire to live well in this world-renowned place. Although the price is higher than in most around the country, you can find your niche. And, once you do, you’ll have all the benefits of sunny skies, pristine natural parks and a culture unlike any other in enjoy. For example, if you’re the type of person who likes to see a movie every week, it’s good to know a ticket costs around $17.89. If grabbing a pizza with friends is your ideal night on the town, it’s best to know the average cost for a pie is $12.99.

Key factors in calculating affordability are 1) your monthly income; 2) cash reserves to cover your down payment and closing costs; 3) your monthly expenses; 4) your credit profile. Explore the best places to buy a house based on home values, property taxes, home ownership rates, housing costs, and real estate trends. It’s important to consider your income, budget, and personal financial situation when evaluating affordability. Researching median housing prices, rental rates, and cost of living indexes can help gauge affordability in different neighborhoods.

For decades, Dave Ramsey has told radio listeners that the best way to buy a house is paying for it in cash. The Loan Estimate (LE) shows your total mortgage costs — including the down payment, closing costs, monthly payments, and interest paid over the life of the loan. A mortgage calculator can be helpful when estimating your home buying budget.

The question isn't how much you could borrow but how much you should borrow. These home affordability calculator results are based on your debt-to-income ratio (DTI). Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income. The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments. The mortgage section assumes a 20% down payment on the home value.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

This is known as a pre-payment penalty and lenders are required to disclose it. But it isn’t only in your lender’s interest to keep this rule in mind when looking for a house - it’s in your's too. Plus, you may have trouble maintaining your other financial obligations, including building up your emergency fund and saving for retirement. Lenders care about your debt-to-income ratio because research shows that people with higher DTI ratios are less likely to keep up with their loan payments. Also, federal regulations require lenders to look at your debt-to-income ratio. You generally can’t get a qualified mortgage that would give you a debt-to-income ratio of more than 43%.

Pittsburgh was found to be the most affordable city for home buyers. The state also has a progressive income tax, where you pay anywhere from 1 to 13.3 percent based on your salary. Angelenos love staying active, whether that means hiking the surrounding hills, running, cycling or trying out a calming yoga class on the beach. However, this is only one area of all the cost of living elements that create your goods and services category.

APR (%) is a number designed to help you evaluate the total cost of a mortgage. The APR is calculated according to federal requirements and is required by law to be stated in all home mortgage estimates. This allows you to better compare how much mortgage you can afford from different lenders and to see which is the right one for you. This loan type is specifically designed for families looking to buy homes in rural areas. Similar to the FHA loan, this home loan lets lower-income families become homeowners.

Comments

Post a Comment